Exploring the Viability of Storage Investing

In recent years, mini-storage units have emerged as an increasingly popular investment choice. They are attracting attention from savvy investors looking to diversify their portfolios.

The storage industry itself has seen remarkable growth. It has evolved into a lucrative asset class within the realm of real estate investing. But what’s fueling this surge in interest?

Key drivers for this trend include increasing demand for storage units due to downsizing and climate-controlled storage needs. This highlights the potential of mini storage units to provide a practical and profitable investment opportunity.

Financial Insights

Diving into the financial side of mini-storage investing reveals some compelling figures.

Mini storage investing looks good on paper. They show an average profit margin, attractive rental rates, and low operating costs. These factors make storage facilities a strong choice for investors.

Compared to other real estate investments, storage facilities have a unique advantage. They provide steady cash flow and can lead to significant returns on investment (ROI).

What sets mini-storage investments apart is their resilience. The stability of storage units sets them apart from residential or commercial real estate. Even in tough economic times, the demand for storage units remains constant. This ensures a consistent income for investors.

Market Trends

The influence of Real Estate Investment Trusts (REITs) specializing in storage facilities on the market cannot be overstated. Publicly traded storage REITs have brought visibility and credibility to storage investing, demonstrating its viability as a profitable venture. Looking at how these REITs perform helps investors understand the storage market’s health and its future growth prospects.

Storage REITs have showcased impressive resilience and growth, often outperforming other types of real estate investments. Their strong performance proves how solid and attractive the storage business model is. It shows why investors seeking stable and profitable options are drawn to it. The success of Storage REITs underlines the sector’s ability to generate high profits and returns.

Cash Flow Considerations

Mini storage units are great for investors because they bring in strong cash flow and high profits. While other investments may see a lot of turbulence, mini-storage units usually have constant demand. This stability translates into consistent cash flow, making them an attractive option for investors seeking reliable returns.

What makes mini storages really stand out is how efficiently they operate and their low costs for upkeep. These factors contribute to higher profit margins, giving investors a direct and steady benefit from their money. The straightforward mini-storage business model, coupled with increasing demand, promises long-term regular income for investors.

Diversification and Risk Management

For real estate investors, spreading out investments is important to reduce risk and keep returns steady. Mini storage units are a great choice for this. Investing in self-storage can help protect against the ups and downs that come with investing in residential or commercial properties.

Because people and companies always need storage for different reasons, mini-storage units stay in demand.This means they keep performing well, even when other investment areas are struggling.

Adding mini storage units to what you invest in helps lower risks. It also takes advantage of what makes the storage market special. This approach makes your investment plan stronger, helping it survive tough economic times and keep making money.

Additional Revenue Streams

One of the often overlooked advantages of investing in mini-storage facilities is the potential to enhance profitability through ancillary services. Adding truck rentals and other services makes mini-storage more convenient for customers. Plus – it brings in more money for the facility.

These extra services make investing in mini storage more appealing. They help fill up units faster and let owners charge more for rent.

Incorporating ancillary services into a mini-storage business model showcases the sector’s adaptability and innovation potential. Finding and using these extra ways to make money can make mini-storage investments more profitable. This leads to better returns and adds more value to your property investments.

Long-Term Investment Perspective

When considering the long-term outlook, investing in mini storage looks promising for ongoing demand and making money. Changes in how people live, like moving more often, cities growing, and always having things to store, show that people will always need storage.

These trends are here to stay, showing that the need for storage units will keep being strong and steady for a long time. This stability makes mini-storage units a valuable asset in real estate investing, offering predictable returns over extended periods.

Strategic Considerations

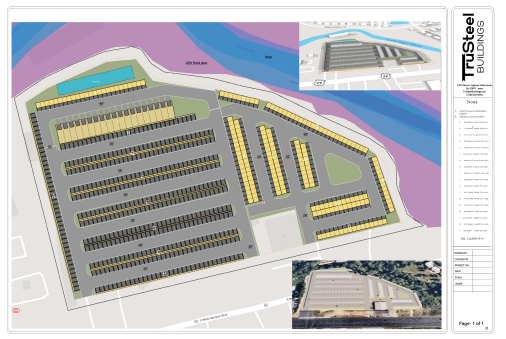

To do well in the mini storage business, you need a well-thought-out plan. This includes doing market research and understanding key factors like location and legal considerations. How well a storage place does depends a lot on where it is. Being close to cities, easy to get to, and easy to see can all help fill up the units and make more money.

Additionally, navigating local zoning laws and building codes is crucial to ensure compliance and avoid potential legal hurdles. Also, questions like “Will this facility require advanced security features?” must be addressed. An informed investment decision involves evaluating these aspects carefully to identify opportunities that align with market needs and regulatory frameworks.

The Investor’s Mindset

For those new to real estate investing, mini storages represent an intriguing option. However, like any investment, they come with their own set of considerations. Beginners should assess market demand, scrutinize local competition, and understand the operational nuances of running a storage facility, including property management challenges.

Identifying a niche can provide a competitive edge. This could be offering climate-controlled units or specialized storage for recreational vehicles. Ultimately, the decision to invest in mini-storage should be based on a comprehensive analysis of these factors. This ensures a well-rounded understanding of the storage business’s potential rewards and challenges.

Determinations

The investment appeal of mini storage units lies in their potential to offer high profit margins, stable cash flow, and resilience against economic downturns. However, success in this sector requires strategic planning, market insight, and an understanding of the operational aspects of running a storage facility.

Prospective investors should carefully consider whether mini storages align with their investment goals, risk tolerance, and portfolio strategy.

Before making a decision, conducting thorough research and consulting with investment professionals can provide valuable insights into the mini-storage market’s nuances. By carefully weighing the unique benefits and challenges, investors can determine if mini storage units represent a suitable addition to their investment portfolio, positioning themselves to capitalize on the opportunities this growing sector offers.

Selecting the ideal roof pitch for your metal building kit is an important decision that hinges on a few key considerations. If your area is prone to heavy snowfall, opting for a steeper roof pitch can help snow management. However, it’s important to balance this with the cost implications, as a higher pitch can increase the overall price of your building.

A 0.25:12 roof pitch strikes that perfect balance for most customers. This pitch is not only cost-effective but is as efficient in bearing snow weight as a 6:12 pitch. While a higher pitch can aid in shedding snow more quickly, remember that it comes with a higher cost. Our goal is to help you make an informed choice that aligns with both your environmental needs and budget, ensuring your building is both functional and financially feasible.

to Learn More or Get a Free Quote